7PLUS

7PLUS COIN (SV7 COIN), which will serve as a utility token for ease of transaction and tracking of COVID-19 medical textile products.

Today, the entire world is reeling from the outbreak of one of the most devastating pandemics in modern history. It has disrupted our work and put our lives in grave danger. The health care system has been faced with the final test, but lack of confidence in the integrity of textile products, medical supplies has become a major problem. Businesses come together to support and keep society moving forward in the best way they can.Penn Asia, a subsidiary of Yeh Group company, responded with the integration of blockchain into the supply chain process for COVID-19 medical textile materials such as masks, gloves, etc. Yeh Group is developing a digital asset called 7PLUS COIN (SV7 COIN), which will serve as a utility token for easy transaction and tracking of COVID-19 medical textile products.

About Yeh Group

Yeh Group is the holding company of Penn Asia with a paid-up capital of 500 million Baht a warp knitting business with its dyeing and finishing. The company is located in Thailand, the heart of Southeast Asia, only 35 km west of Bangkok. Yeh Group produces functional fabrics (intimate wear and sportswear) for the global market. The company mainly produces nylon and spandex yarn, although spandex polyester is gaining popularity as a stiff fabric. Yeh Group has worked with leading regional brands for underwear and sportswear for more than 25 years.

Tokenis Consumer Textile

SevenPlus Coin is an industry grade public blockchain that will revolutionize the textile industry.

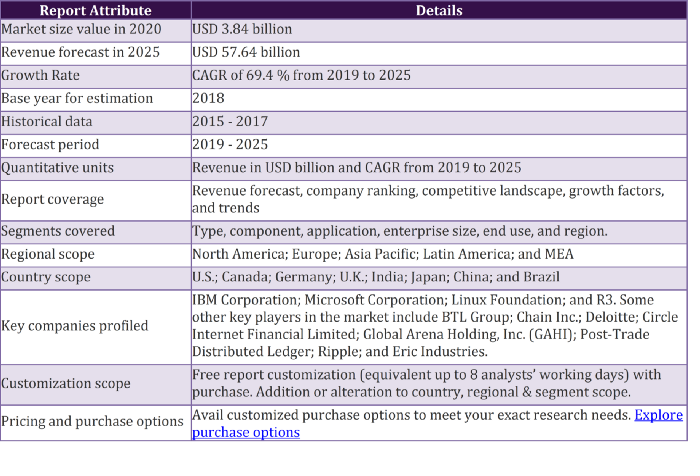

The global blockchain technology market size was valued at USD 1,590.9 million in 2018 and is expected to grow at a CAGR of 69.4% from 2019 to 2025. Blockchain technology is one of the most promising future technology trends in the information technology domain. This allows a ledger that is accessible to the parties involved in the transaction and can act as an undeniable universal repository of all transactions between the parties involved.

The multitude of benefits involved in developing such a platform has attracted attention and hence, investment, from the financial sector as well as many tech giants. Technology not only has the ability to disrupt the way the financial sector works but will also impact many other industries including consumer goods, and media & telecommunications, among others.

Innovative requests for all Bitcoin transactions; blockchain technology has also included other cryptocurrencies, including Litecoin, Ripple, and Mintchip. Many financial institutions and banks are attracted to this technology, because of its unique and innovative structure with regulatory bodies, such as the International Monetary Fund (IMF) and the Bank of England, which have shown great interest in this issue.

Many players in financial markets are looking for investment opportunities and many have already made first-stage investments to develop products and services in the industry. Although the market may grapple with regulatory uncertainty and security concerns, the coming years are expected to see a greater role for related technologies in financial transactions, spanning a wide range of domains and industries.

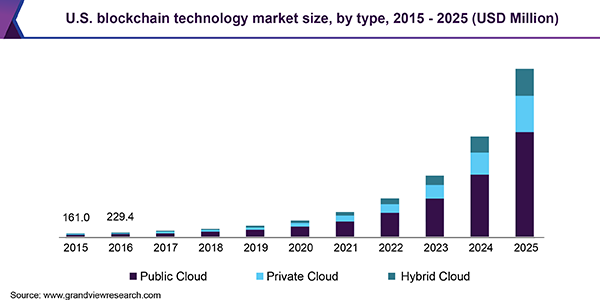

Type Insights

By type, the market is divided into public cloud, private cloud and hybrid cloud. The public network is the most dominant segment in the market due to the increasing tendency of government and institutions to conduct open and efficient transactions. For example, the Australian Stock Exchange (ASX) announced that it intends to move the Australian settlement and clearing system to a blockchain platform.

The private network segment allows companies to change rules and reverse transactions at relatively cheaper transaction rates. This network allows error repair by manual intervention and at very high speeds. Private networks are expected to follow the public segment, albeit with caution, and may see a sizeable increase in adoption in the coming years.

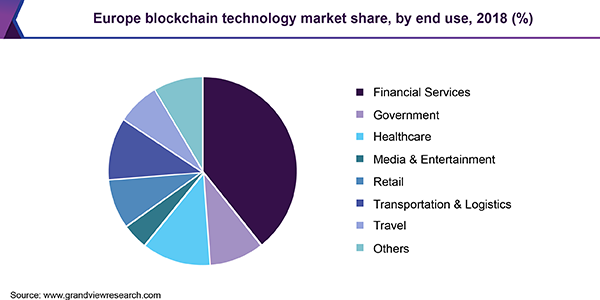

End Use Insights

Blockchain technology tends to greatly benefit financial transactions that occur in businesses around the world by providing anonymity, openness, and efficiency by leveraging the capabilities of the internet age. The financial sector benefits the most from technology and has been a proactive partner and investor in development from an early stage. For example, in September 2016, Bank of America Merrill Lynch teamed up with Microsoft Corporation to automate and digitize the credit scoring process with blockchain technology. A digital process that aims to increase audit transparency and reduce the risk of counterparties.

Blockchain Technology Market Report Scope

Segments Covered in the Report

This report estimates revenue growth at the global, regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For the purpose of this study, Grand View Research has categorized global blockchain technology market reports by type, component , application, company size, end use

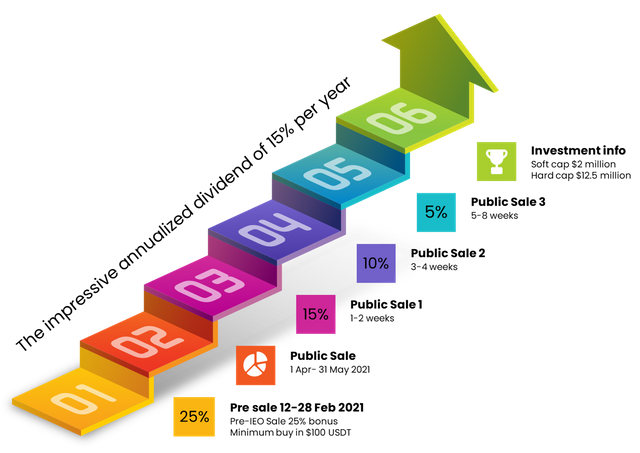

The initial stage for the most exhilarating activity that the digital currency space has to bring.

Pre Sales:

Pre Sale will start Fri, 12 Feb 2021 07:00 (GMT + 7)

% BONUS: ETH

Complete sales: 0.0000 (0.00%) SV7

Softcap period: 16 days

Hardcap period: 60 days

Today: 0 SV7

Complete ETH: 0.0000 ETH

Softcap: 20,000,000 SV7

Token details:

- Name: 7PLUS COIN (SV7)

- Date: Fri, 12 Feb 2021 07:00 (GMT + 7)

- Price: 1 SV7 = 0.10 USD

- Home: https://7pluscoin.com

- Bonus: 0%

- Softcap: 20,000,000

- Hardcap Lockout Bonus: 180,000,000

- Technician: ERC-20

Roadmap

Jan 2020

Presenting and spreading the 7PLUS Brand to local and world markets. Legitimate tokens and local L2L tokens depend on improving the monetary model on the ERC20

Feb 2021:

Official business declaration. The arrival of white papers and different stages of web based media. Open to the public for Presale, Private deals, and subtle restrictions via IEO on Bitenium trading.

Apr. - May 2021:

7PLUS opens the general public through retail outlets and internet businesses. Start and offer a hard cap and deployment of 7PLUSCOIN to financial backers

K4 2021:

Rundown on Coinmarketcap.com. 7PLUSCOIN is open for public exchange on Bitenium trading. Programming an inventory network for Drydye and our clinical materials and 7PLUS retail outlets worldwide.

K1 2022:

Street shows and mastery group presentations behind 7PLUS. Demonstrate the latest styling and excellence of athletic apparel, underwear and clinical fabrics with Drydye innovations.

Q3 2022: Q3 2023

Buy back and consume 20% of 7PLUSCOIN. The absolute buyback will be 40%. The remaining tokens will flow on the trading market.

Team:

The team is a good mix of experts from various fields.There are experts in business administration and mechanical engineering as well as software development and finance.All important employees can look back on long and successful careers and bring the necessary experience to the company.

Jimmy Yeh - President

Chareeporn Yeh - Vice President

Negel Pages - CMO Sales and Marketing

Prathya Thanasomboon - CPO Administration

Sorin Mic - Operations Director

David Round - Director of Innovation

X 10 Agency - Bounty, Marketing & Community Management

Consultant

Clinical Advisor

Dr. CHITTIWAT SUPRASONGSIN

Blockchain Consultant Advisor

Dusit madan

Kanjana Wattanavichean

Chanin Torut

For more detailed information, please contact the link below:

- Website: https://7pluscoin.com/

- Facebook: https://www.facebook.com/SV7PlusCoin-103483088392823

- Telegram: https://t.me/English7plus

- Twitter: https://twitter.com/7pluscoin

- Youtube: https://www.youtube.com/channel/UCqqoJ6ai6yLzmcFw_ZxUfJw

- Media: https://seventhcoin7.medium.com/

- by ; zaka72 link: https://bitcointalk.org/index.php?action=profile;u=2579374

Komentar

Posting Komentar