Metavault Trade

- Metavault.Trade — Decentralized Exchange Platform With Leverage Up To 30x

Author

Metavault.Trade – Cryptocurrency is an encoding of data strings that represent units of currency. The Peer-to-Peer network, called blockchain, monitors and manages cryptocurrency transactions, such as purchases, sales, and transfers, and is used as a secure classification account for transactions. Using encrypted technology, cryptocurrencies can be used as currency and accounting systems.

Cryptocurrencies are used to exchange numbers or virtual currencies. It is very similar to real currency, except that it is without physical reflection and uses encryption functions to run.

Since cryptocurrencies work and spread independently, there is no bank or central authority, so new entities can only be added if they meet certain requirements. For example, in Bitcoin, miners get Bitcoin rewards after adding blocks to the blockchain. Only in this way can only be produced. Bitcoins are limited to 21 million; After that, Bitcoin will no longer be produced.

Metavault.Trade is an exchange platform that provides decentralized crypto exchange services designed with various crypto features. Metavault.Trade provides spot & perpetual exchange services that allow users to trade with up to 30x leverage and directly from their personal wallet. Metavault.Trade is an innovative decentralized exchange platform as it provides spot & perpetual exchange services where users can trade safely and easily without going through an account, but simply by connecting their wallet and they will be able to trade. So it is a decentralized crypto exchange platform with leverage and convenience for users.

What is Metavault.Trade?

Metavault.Trade is a new type of Decentralized Exchange designed to provide a wide range of trading features and very deep liquidity on many large cap crypto assets. With Metavault Trade you can trade top cryptocurrencies with up to 30x leverage right from your personal wallet. Metavault.Trade is a state-of-the-art Decentralized Exchange platform that does not require registration. To start trading in Metavault. Trade all you need is a Web3 wallet.

Metavault Trade Is A Decentralized And Perpetual Exchange With Low Swap Fees And Zero Price Impact Trading. Trading is Backed By Multi-Asset Pools Which In Turn Backed By Liquidity Providers.

Trading is Backed By Multi-Asset Pools Which In Turn Backed By Liquidity Providers. Liquidity Providers Receive Rewards From Swap Fees, Market Making, Rebalancing And Leverage Trading. MVX Uses Oracle Chainlink And TWAP Pricing From A Large Volume Decentralized Exchange For Dynamic Pricing.

Metavault trading is a decentralized attraction and permanent exchange. Transaction fees are low, and prices affect inactive transactions. These transactions are backed by multi-asset pools, and the pools are backed by liquidity providers in turn.

These transactions are backed by multi-asset pools, and the pools are backed by liquidity providers in turn. Liquidity providers will be rewarded with fall and market fees for monetizing, refunding, and using transactions. MVX uses a large number of scattered chains and swap prices for dynamic pricing.

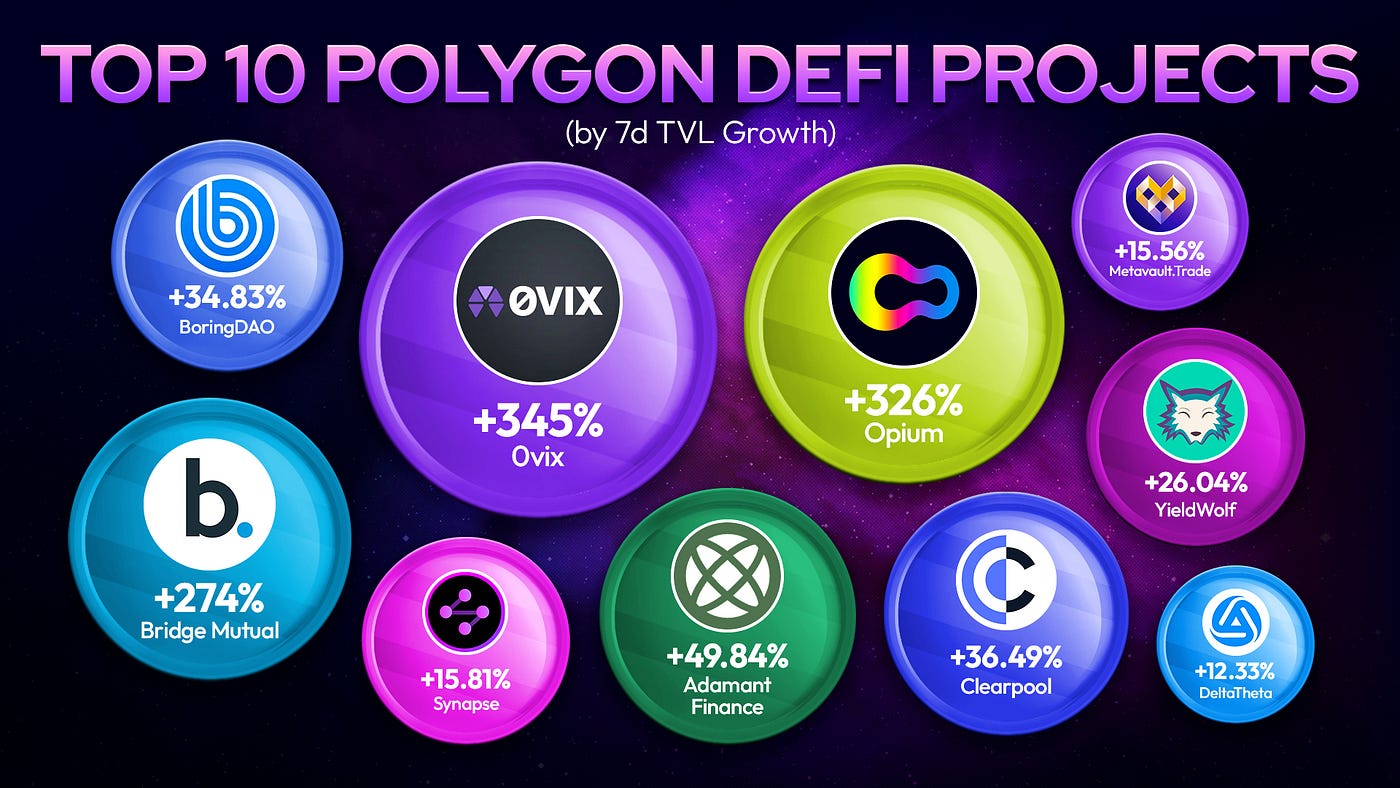

This Metavault project has had a successful journey, and I wish you all the best in the future. My audience is encrypted and I always support such a good project.

Metavault.trade is a new type of decentralized exchange, which aims to provide various transaction functions and deep liquidity on many major crypto assets.

Problem

Most of today's crypto users trade through centralized exchange platforms. Through this exchange platform, users will be able to trade crypto easily and securely. But the problem is that usually centralized exchange platforms use KYC for their trading which is problematic for some as it is related to their identity and privacy. Whereas users should be facilitated with a crypto trading platform that will make it easier for them to trade and not ask for their identity so that users will be able to trade freely without worrying about their privacy.

The solution

And in response to this issue, Metavault.Trade was launched as a decentralized exchange platform that would not question the identity of its users. This service is provided by Metavault.Trade is a decentralized & perpetual exchange, which will allow users to trade quickly and securely with leverage through their personal wallets. Since it only requires a connection to the user's digital wallet, it means that Metavault.Trade does not require the creation of an account for the user. Users will be able to trade their favorite pairs freely without worrying about their privacy.

Metavault Exchange Features

Low Fees - Very low transaction fees.

No price influence, even for large order sizes.

Simple Swap - Open positions via a simple swap interface. Easily swap from any supported asset to your preferred position.

Reduced Liquidation Risk - Protection against liquidation events: sudden price changes that often occur in a single exchange (“scam wicks”) are smoothed out by the design of the price mechanism.

Complete platform: spot trading and leverage.

Multi-asset pools - The key innovation at the heart of Metavault.Trade is multi-asset pools. This feature allows the platform to share liquidity across all the assets it supports.

Metavault.Trade . Ecosystem

MVLP ( Liquidity Provision Incentive) - MVLP is a liquidity token platform. Metavault.Trade requires a multi-asset pool with a lot of liquidity. To ensure this happens, the platform has a very generous incentive program: 70% of the platform fees are redistributed to liquidity providers who score MVLP by accumulating their crypto assets. MVLP acts as a counterweight to leverage traders on the platform, with their losses flowing back into MVLP.

MVX - Metavault.Trade has its own governance and utility token: MVX. Holders are incentivized to stick around for the long term, with many rewards accumulating quickly. MVX marketers will get 30% of the fees collected by the platform in the form of the network's native token — MATIC on Polygon.

MVLP

The MVLP consists of an index of assets used on the platform for swap and leverage trading. The user can score MVLP by adding any index asset to the liquidity pool (LP) while the MVLP is burned whenever the user removes any index asset from the LP.

MVLP holders get rewards in the form of MATIC and esMVX tokens.

The MVLP token is designed to supply the liquidity needed for leveraged trading. Thus, MVLP holders are suppliers of liquidity and they make a profit when leverage traders make losing trades. Instead, they lose money when the leverage trader makes a profitable trade.

Rebalancing

The cost of the MVLP casting or redemption will be consistent with whether the operation at that time complies with the request of the agreement. For example, if the index has a large proportion of ETH and a fraction of USDC, then the inner index will increase the number of ETH indexes which will earn high fees.

Adjust the token weight to help MVLP holders hedge according to the trader's open positions. For example, if there are lots of ETH traders for a long time, ETH will have a higher token weight. If many traders are short, it will give stable weight.

If the token price goes up, even if many traders have long positions on the platform, the MVLP price will go up. Parts ordered from long positions can be said to be stable according to the value of the US dollar, because if the price goes up the profit will be used to pay the trader, and if the price goes down, the trader loses. will retain equal to the US dollar value share of the reserve value.

About Metavault.Trade

Understanding why I think Metavault.trade is a great project, I would like to describe it as part of: "Decentralized Division Trading". If you've got it all figured out, you can skip this part!

Decentralized transactions

I think all my readers know what transactions are concentrated. This is the behavior of buying/selling assets on a centralized exchange (such as binance, kucoin, or coinbase). These platforms have both advantages and disadvantages: they can provide low transaction fees and provide great flexibility through APIs and robots. But they also require different levels of KYC usage as a good thing, until they are hacked and your personal data can use the imagination of every bad actor. Sometimes they freeze you from your only excuse. assets. In the worst case, they are attacked by hackers and you will lose everything on the platform. “Not your keys, not your cryptocurrency!” As the saying goes.

Diversified Applications (DAPP) solves some of these problems by transferring transactions to the blockchain and providing a decentralized transaction solution. Uniswap is probably the most well-known decentralized exchange (dex). You don't need KYC, you can use it anywhere in the world. However, Ethereum fees may be 10 to 100 times higher than the price of similar transactions on CEX, especially for those of a smaller size. Decentralized pricing at high power! Metavault.trade is a new generation of Dex which brings a lot of innovation and very low cost.

- Futures contract

When people initiate a transaction, they usually start with a “spot transaction”, which includes buying and selling assets directly on the market. However, there are more complicated tools called term or "future" contracts for short:

A futures contract is an agreement that buys or sells goods, currency, or other instruments at a scheduled price at a specified future price.

Unlike the traditional spot market, in the futures market, the transaction will not be "completed". In contrast, two counterparties determine the future settlement in the contract. In addition, futures markets do not allow users to buy or sell digital goods or assets directly. Instead, they trade contract representatives from these people and will transact actual assets (or cash) when executing future [reference] contracts.

These contracts are invented, so they can protect against changes in the market, but futures transactions also provide more possibilities than spot transactions:

Traders can “short”: they can even bet on assets without owning any assets.

Traders can use leverage: they can include the rest. But in this way, they risk losing all balance against the market, even a little. Using high levels of leverage (10x, 20x…100x!) is very dangerous. If you are not an expert trader, you will definitely avoid it!

MVLP

MVLP is a token whose value consists of an index of assets used in swap and leverage trading. User Can Print MVLP Using Any Index Asset Or Burn It To Collect Index Asset. The Printing Or Redemption Price Is The Combined Value Of The Indexed Assets / MVLP Supply. MVLP Holders Earn EsMVX. Because MVLP Holders Provide The Necessary Liquidity For Leverage Trading, They Profit During Metavault. Trader Leverage Trader Makes a Losing Trade. They Also Lose When Leverage Merchants Make Profitable Trades, With Their Guaranteed Towards Payouts.

Team

Metavault.Trade is built by professionals and experts in their field who have years of experience in blockchain technology and understand the crypto market. The team is collaborating together on developing a decentralized exchange that will be used by many people globally easily and securely. With this collaboration, it is hoped that users can get the best service, where they can transact safely, quickly, and at lower costs through their devices.

Detailed Reward Mechanism

MVX holders are strongly encouraged to stake their tokens on the platform as it provides them with three different types of rewards. They get:

Part of the platform fee — paid in MATIC.

New token: esMVX, which generates its own rewards.

Multiplier Points (MP) which is another way to increase your MATIC earnings even more.

Let's examine each of these gifts and how they are added in detail.

MATIC rewards from platform fees

In the case of blockchains other than the Polygon network, rewards are paid in native tokens of the blockchain, e.g. NEAR in the case of Near Protocol.

Metavault.Trade generates revenue by charging traders a small fee when they use the platform for the following:

Swap — fees vary according to the level of assets exchanged in the pool.

Opening and closing trades — costs 0.1% of position size.

Borrowing to increase trading or short assets — 0.01% fee * (assets borrowed) / (total assets in the pool), deducted at the beginning of each hour.

Another situation that generates fees for the platform is when:

Traders with leveraged positions are being liquidated — 10% fee of positions.

Liquidity providers score or redeem MVX — this is called a “rebalancing fee”, it depends on the state of the pool.

Link

Website: https://metavault.trade/

Twitter: https://twitter.com/MetavaultTRADE/

Telegram: https://t.me/MetavaultTrade/

Useful links:

Must Join Both

Discord > https://discord.gg/metavault

Telegram > https://t.me/MetavaultTrade/

Twitter: https://twitter.com/MetavaultTRADE/

by ; zaka72 link: https://bitcointalk.org/index.php?action=profile;u=2579374

Komentar

Posting Komentar